Winnipeg Budget's Winners and Losers (Part 1)

Council decides not just who gets city services, but who pays for them.

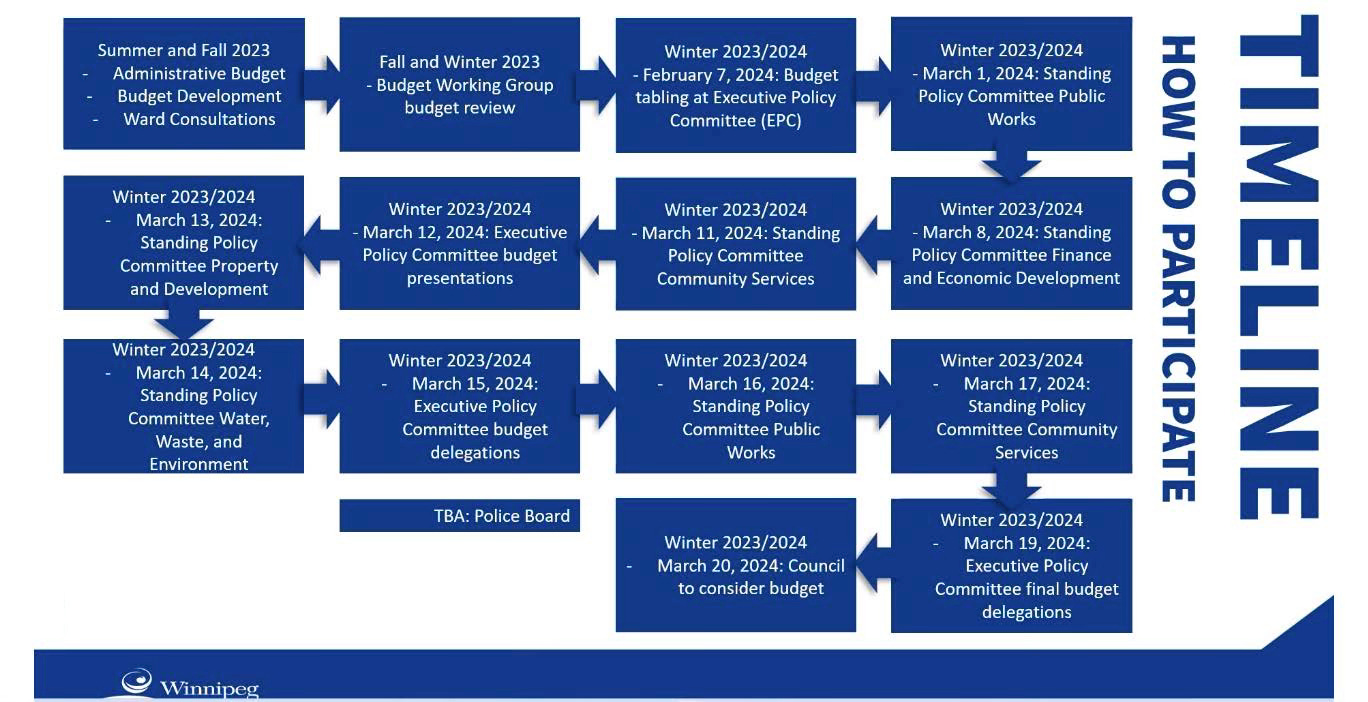

The City of Winnipeg released its “draft” 2024-2027 budget in February, going to City Council for approval on March 20th. I put draft in quotations marks because, realistically, very little, if anything, will change between the release of the “draft” and the final budget. If this year is like all previous years, the public will come and present to the various committees at City Council, asking for changes to the “draft” budget, but in the end, no real changes will be proposed to the budget, and it will pass as presented in “draft” form.

There is a real discussion that needs to happen on how the City of Winnipeg can have a better and more inclusive budgeting process. After all, the 4-year budget lays out what we want to accomplish over the term of this council. It should set a clear direction for where we, as a city, want to go in the future and steps towards that vision. I’ve discussed this before, and I am sure we will be talking about this again.

Winnipeg: Proving Einstein Right

Einstein is often quoted as saying the definition of insanity is doing the same thing over and over again and expecting different results. When it comes to the Winnipeg budget, Winnipeg City Council has updated that rubric by doing the same thing and not even pretending to expect a different result.

Where is the Vision?

There it is. The vision statement that should guide City Council and its decisions, and the question that needs to be asked about this budget: is this making a “vibrant, healthy, and inclusive city for all Winnipeg residents and visitors”? Sadly, the answer remains the same: no.

So, what is the result of the City of Winnipeg budget for 2024 to 2027? Well, in an interview I did immediately following the budget release I was asked who the winners and losers are. The short answer is that homeowners in the suburbs are the winners, and renters in the inner city are the losers.

So let’s have a quick look at what is in the budget. You can check it out yourself on the City of Winnipeg website here: Winnipeg 2024-2027 Budget. The Winnipeg Free Press also did a quick overview of the budget when it was released: “Proposed Budget Holds Property Taxes at 3.5%”.

The budget has a declaration of Council Priorities for the next 4 years:

I’ve spent a bit of time digging through the documents in order to understand what is proposed and what the ”vision” and council priorities are and how they propose to achieve them.

Budget Snapshot

I have pulled out some of the highlights (to me) in the numbers.

The Good

First off, there are some good things in this budget. Here are some of the things I think are good signs:

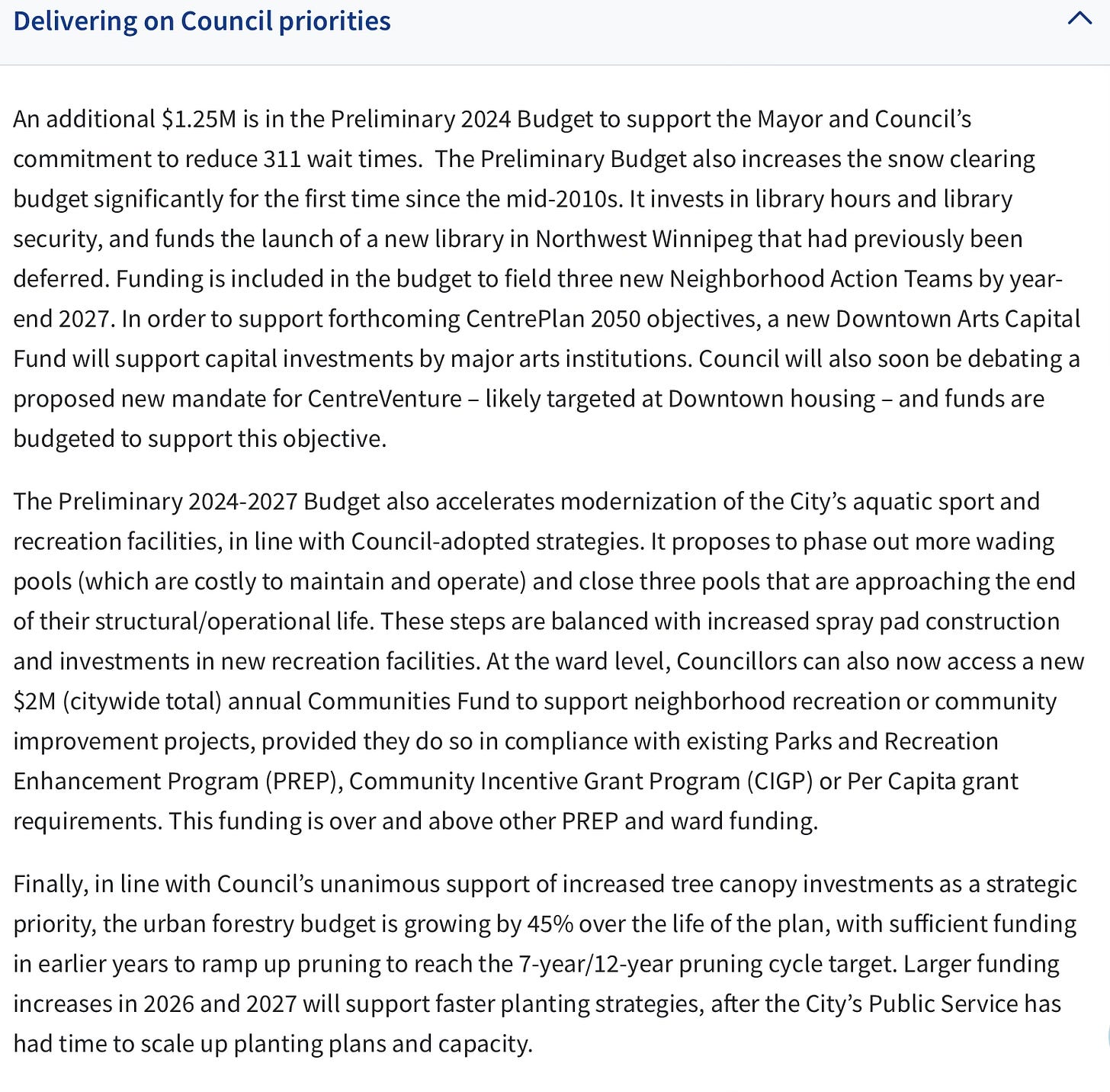

increased spending for trees

increased spending and attention to the public realm in the downtown

one time special event fund should be good for downtown vibrancy

small increase for libraries & more librarians

postponement of work on Chief Peguis, Kenaston and Arlington Bridge

increase in snow clearing budget with an emphasis on sidewalks

The Bad

Of course, there are some not so good things in the budget as well:

pretty much every user fee has big increases each year (5%,5%, 2.5%, 2.5%) with authorization for staff to go bigger than that if needed

closing 3 pools, closing 20 wading pools, examination of the future of Kinsmen Sherbrook Pool

Transit fares going up, though there is a commitment to bring full transit service back in 2025 (caveat here is that last year the commitment was full transit service by September 2023)

Police budget going up $6M in 2024, $35M overall (on a “positive” note, the police budget will now be 28% of the city budget, down from 29% last year)

The Ugly

And then there are the things that are missing or ignored within the budget.

This is a 4-year budget, but really a 3-year plan. The 4th year in the budget is based on hope to get money from Federal and Provincial governments

Throughout there is a hope the province and feds start funding the city more

Most of the increases in funding for programs don’t kick in until 2025… 2024 sees a decrease in most funding

Addressing climate change… is completely missing!

The Shifting Balance

Budgets are always balancing acts. You can never get everything you want, you always have to make choices on priorities and timing. Council, and all elected officials for that matter, have to take all of the things they would like to accomplish, all of the things that members of the public would like to see accomplished, and balance that with what they are willing to spend. And spending always comes down to available revenue.

One of the considerable limiting factors for municipalities right across Canada is that they are prohibited from running a deficit. Provincial governments and the federal government are allowed to have deficits, and frequently do. This allows them to decouple spending from revenue in any given year (especially in election years!!!) and be able to accomplish more wishlist items in the short term. Municipalities just don’t have that luxury.

The inability of a city to run a deficit forces much more stark budget decisions. It also makes it all the more important to tie a budget to the long-term vision and plan for the city.

While it is challenging to find a long-term vision for the City of Winnipeg in the 2024-2027 budget, there are very clear choices that are being made in the balance of priorities. And it is those choices that show us who the winners and losers are.

Homeowners Vs Renters

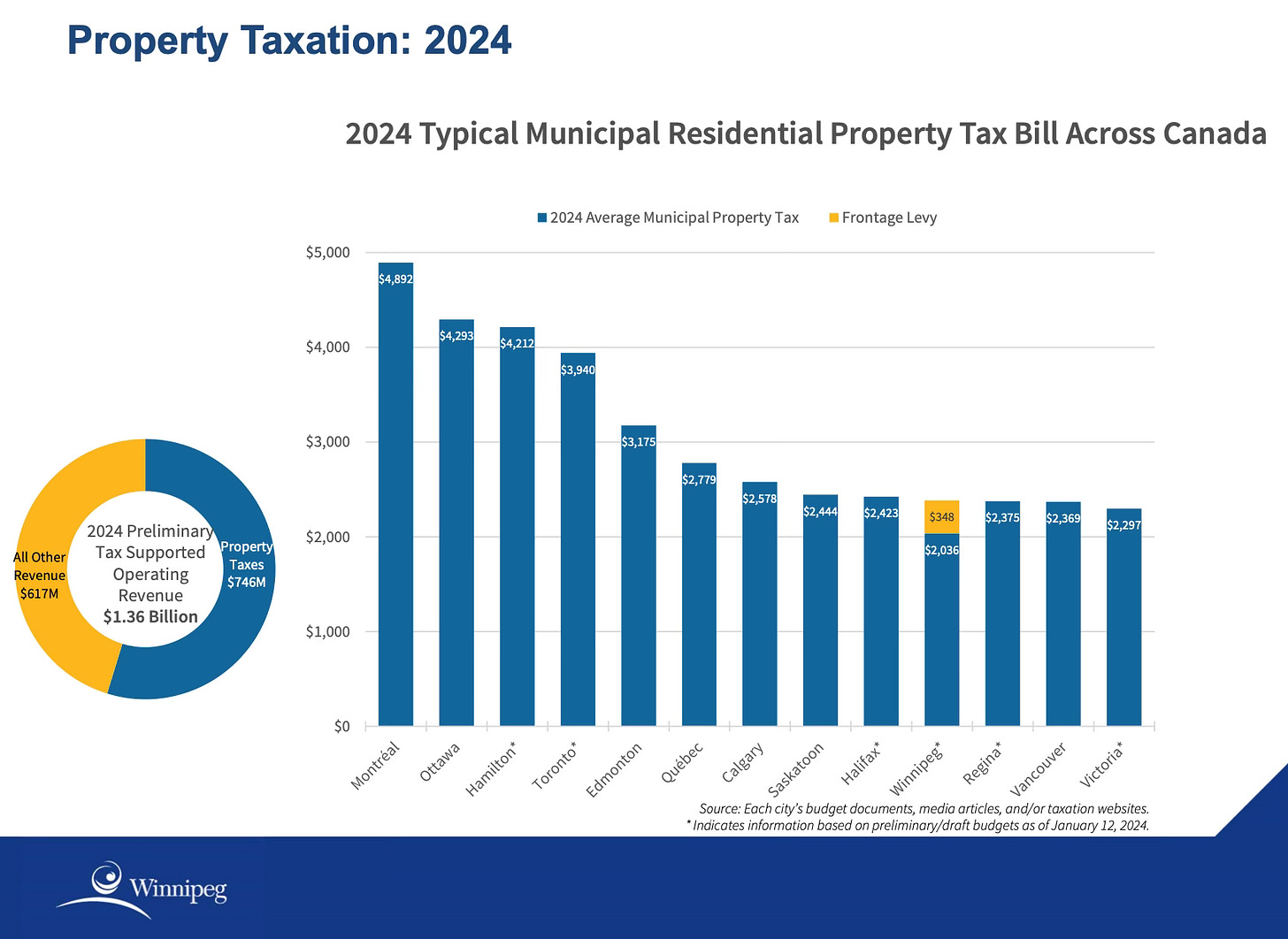

Committing to a 3.5% property tax increase and no increases in frontage levies means that homeowners are seeing a very modest increase in their taxes. That works out to about $70 a year for the average home in Winnipeg. That 3.5% is far below the increase in costs, and when you add in population growth it comes to, as one councillor put it, about a 2% cut. In order to keep those property taxes low, and not cut services too deeply, Council is increasing licenses, permits, and user fees, by 5% per year.

The impact of this shift from a reliance on property taxes to user fees has been happening for a while, it’s something the City of Winnipeg is proud of. After all, Winnipeg now has the lowest property taxes of any big city in Canada! (as someone who moved here from Calgary, I can attest that Winnipeg property taxes are obscenely low).

The Equity Shift

The shift towards a greater reliance on user fees seems on the face of it to be a good thing. That means that those who use the service are the ones who pay for them. Except, the burden on a lower-income renter for that user fee is far greater than on a wealthier homeowner. Often, it is lower-income residents who are more reliant on public services, such as transit, recreation, libraries, and leisure programming. User fees take a considerably larger percentage of a lower-income than a more economically affluent person.

An example of this are ATM fees at the bank. Say your bank charges you a user fee of $1 for every ATM transaction. If you have more money in the bank, you take out $200 at a time. That means you are paying a 0.5% user fee for the transaction. But, if I have less money in the bank and can only take out $20 at a time, my “equal” transaction fee of $1 is now a 5% user fee. I have less so I pay a great proportion.

Choices Made

What we are seeing, here and in many other municipalities, is an equity shift. It has been going on for a while. Local politicians are always talking about the “taxpayer” and needing to address their concerns. And yes, of course we do. But “taxpayer” cannot be a replacement for “citizen”. Taxpayers are a subset of all the residents in the community. It is right there in the City Vision to have a vibrant city “for all Winnipeg residents”, not just home owning taxpayers.

The more we make the “tax payer” paramount, the more we focus on keeping property taxes low and compensate for that with user fees, the more in-equity grows. We are expanding the gap between the have and have-nots within our community. We are choosing one group of residents interests over others.

Budgets are about choices. City Council is making the same choices it has been making for years, favouring one type of resident over others. This budget, with its stark emphasis on lower property taxes and higher user fees is only exacerbating the inequities that are already front and centre for all to see.